Diversification only insulates a portfolio from decline if assets remain uncorrelated. Stock market crashes are largely non-diversifiable within the stock market. This is because the correlations between stocks increase dramatically in volatile market conditions. Such is the fate of Direxion’s Daily Technology Bull fund, hereinafter referred to as TECL.

The following companies comprise the top ten components of TECL, abstracted on 16 March 2020 and alphabetized by company name:

- Accenture (ACN)

- Adobe (ADBE)

- Apple (APPL)

- Cisco (CSCO)

- Intel (INTC)

- Mastercard (MA)

- Microsoft (MSFT)

- Nvidia (NVDA)

- Salesforce (CRM)

- Visa (V)

Each company was added to the Security Explorer on our Ticksift platform. Closing prices for the last year, year-to-date, and the last month were pulled, and correlations between securities were charted as correlograms.

Figures and Commentary

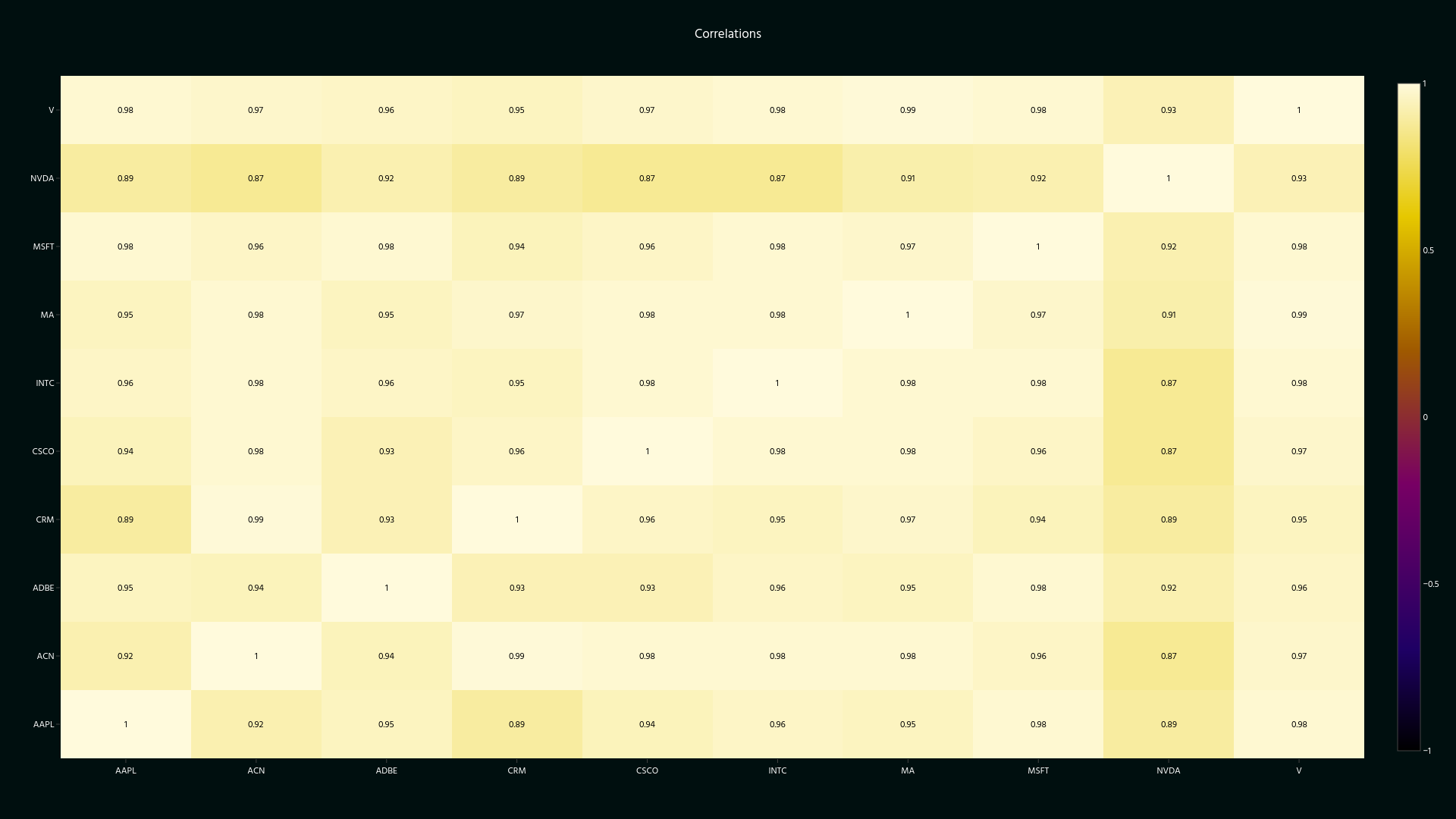

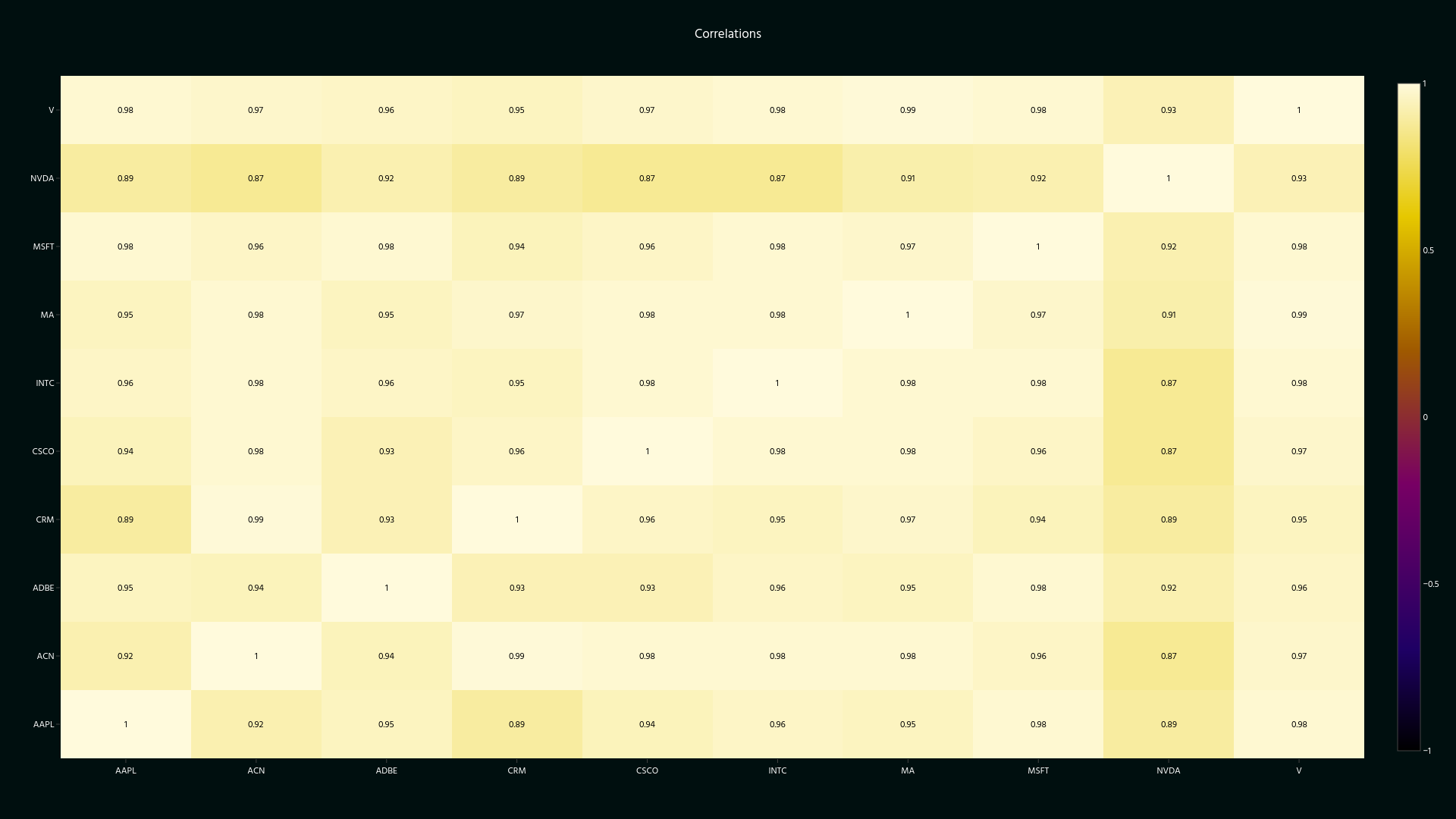

Correlograms of decreasing look-back period are presented in trio. Their increasing pallor implies increasing correlation.

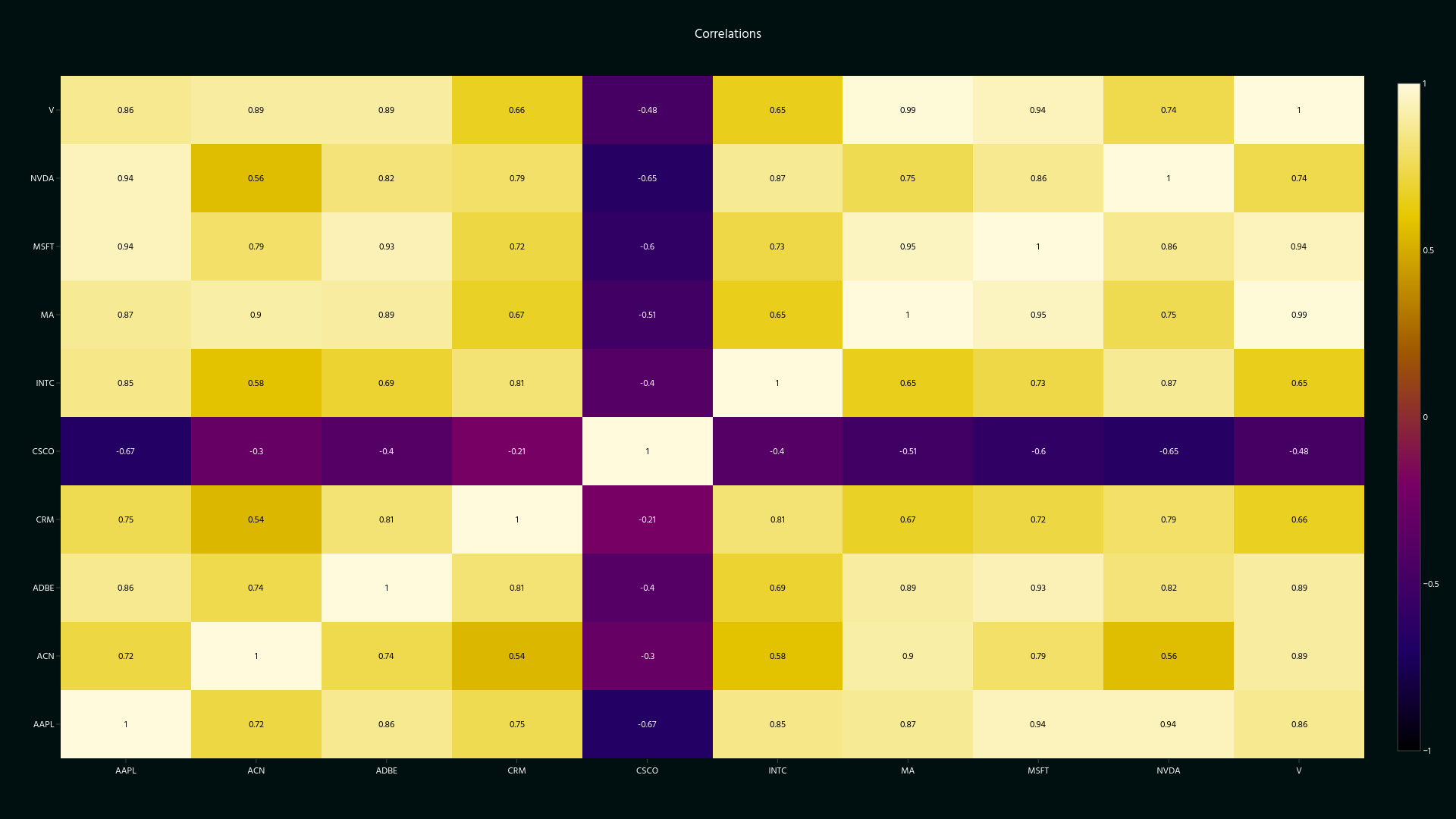

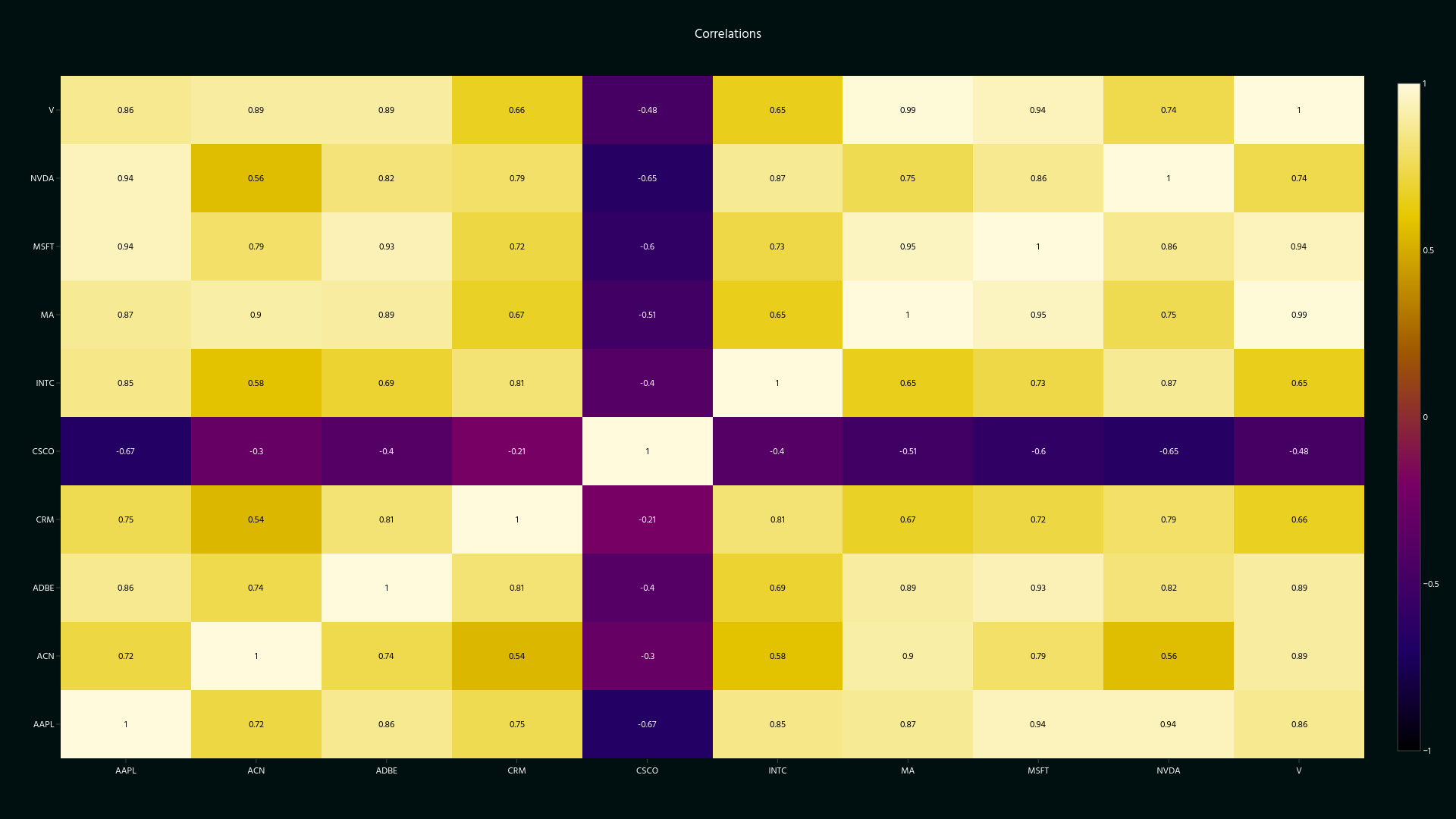

Fig. 1: Correlogram for TECL securities from 2019-03-13 to 2020-03-13

Fig. 1: Correlogram for TECL securities from 2019-03-13 to 2020-03-13

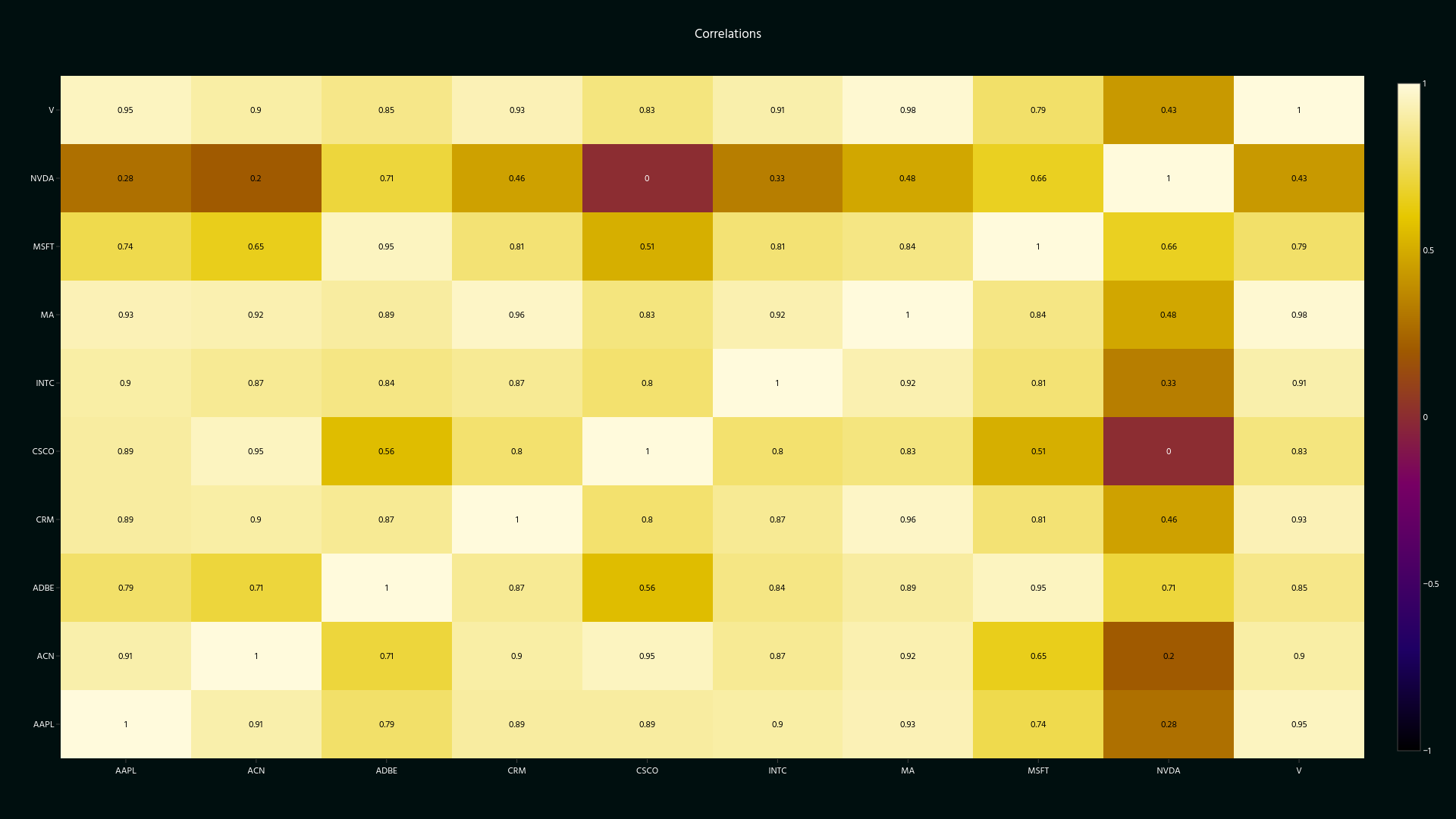

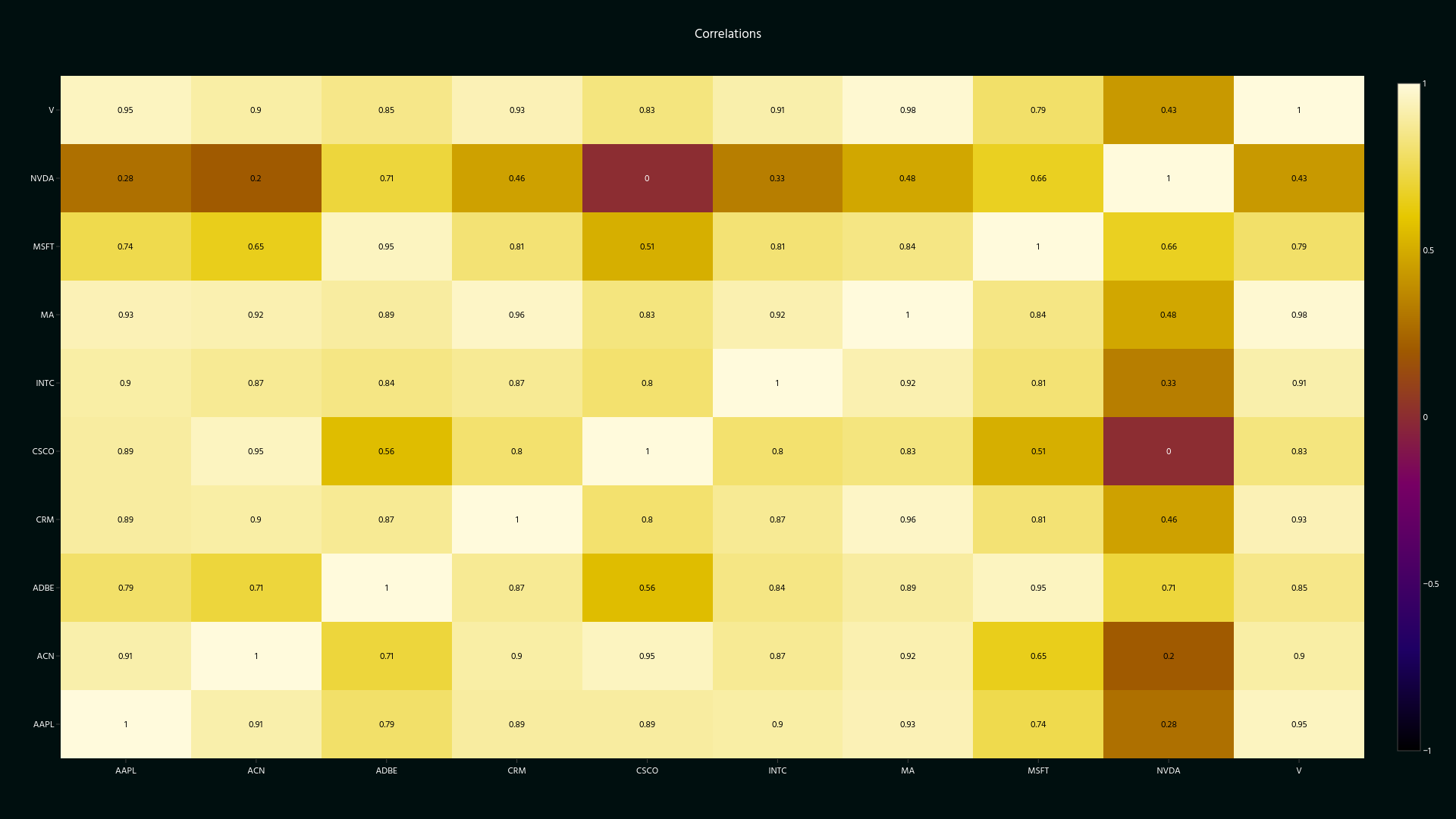

Fig. 2: Correlogram for TECL securities from 2020-01-01 to 2020-03-13. All correlations are nonnegative.

Fig. 2: Correlogram for TECL securities from 2020-01-01 to 2020-03-13. All correlations are nonnegative.

Fig. 3: Correlogram for TECL securities from 2020-02-13 to 2020-03-13. The palest palette yet.

Fig. 3: Correlogram for TECL securities from 2020-02-13 to 2020-03-13. The palest palette yet.

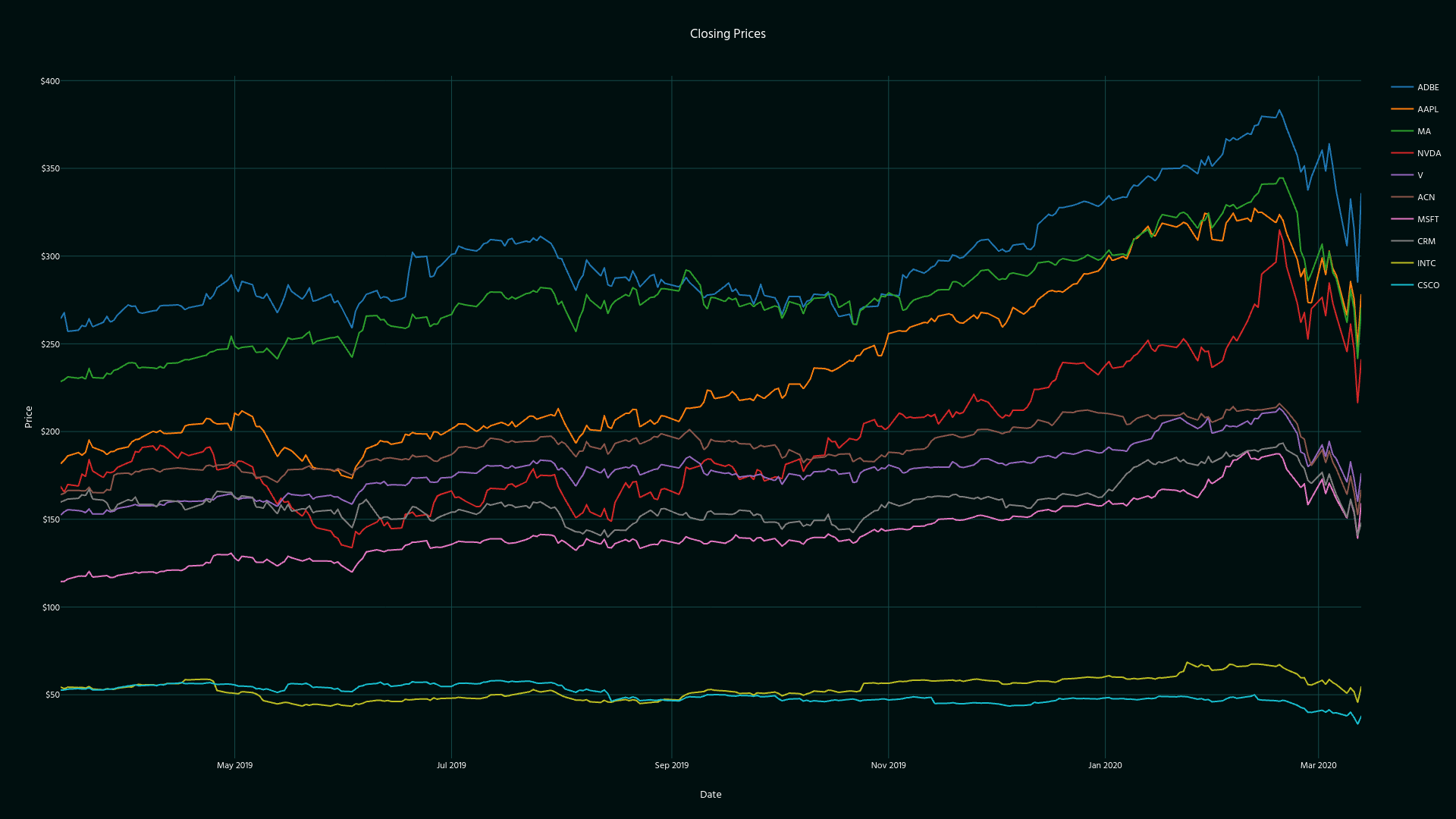

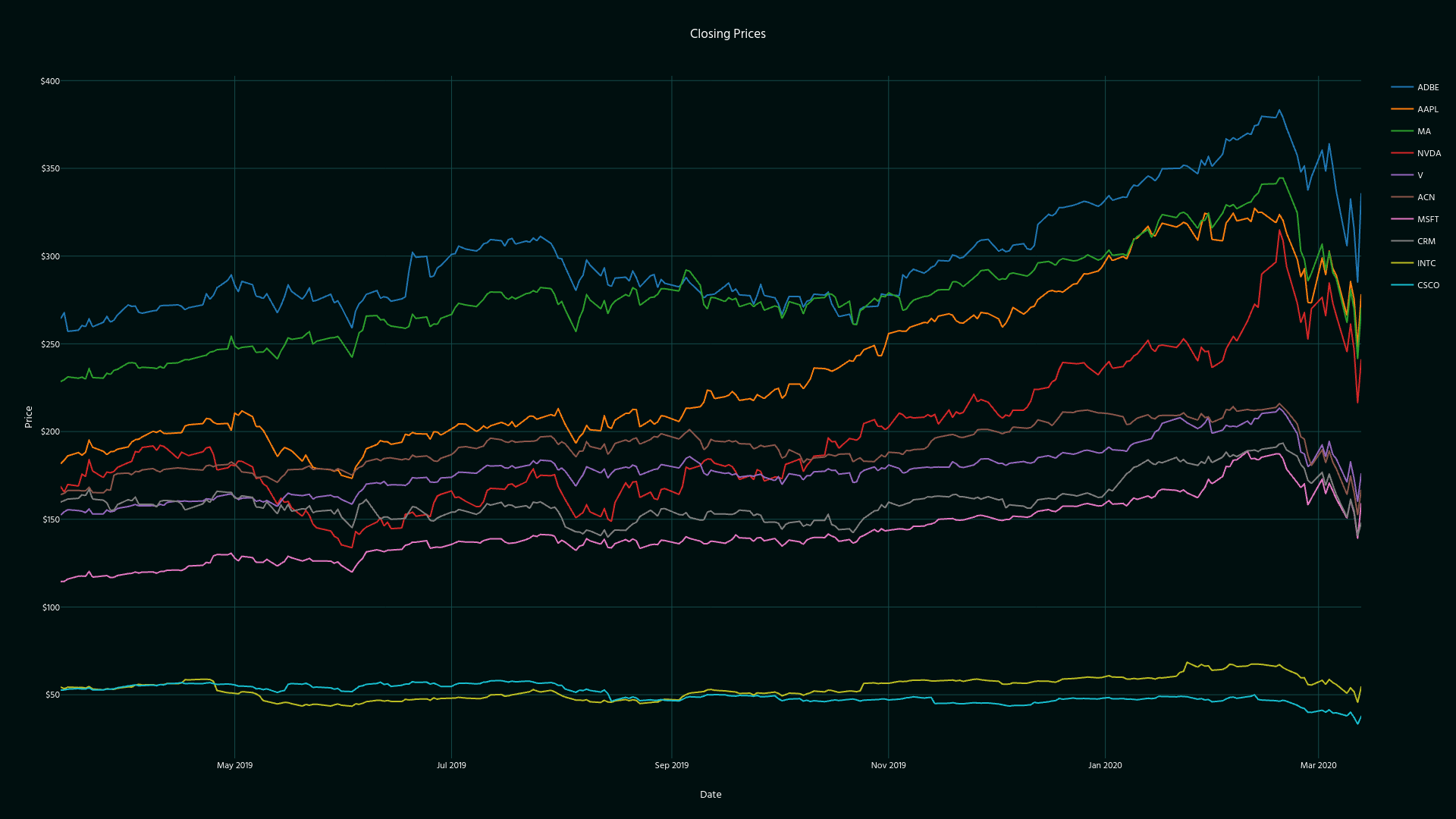

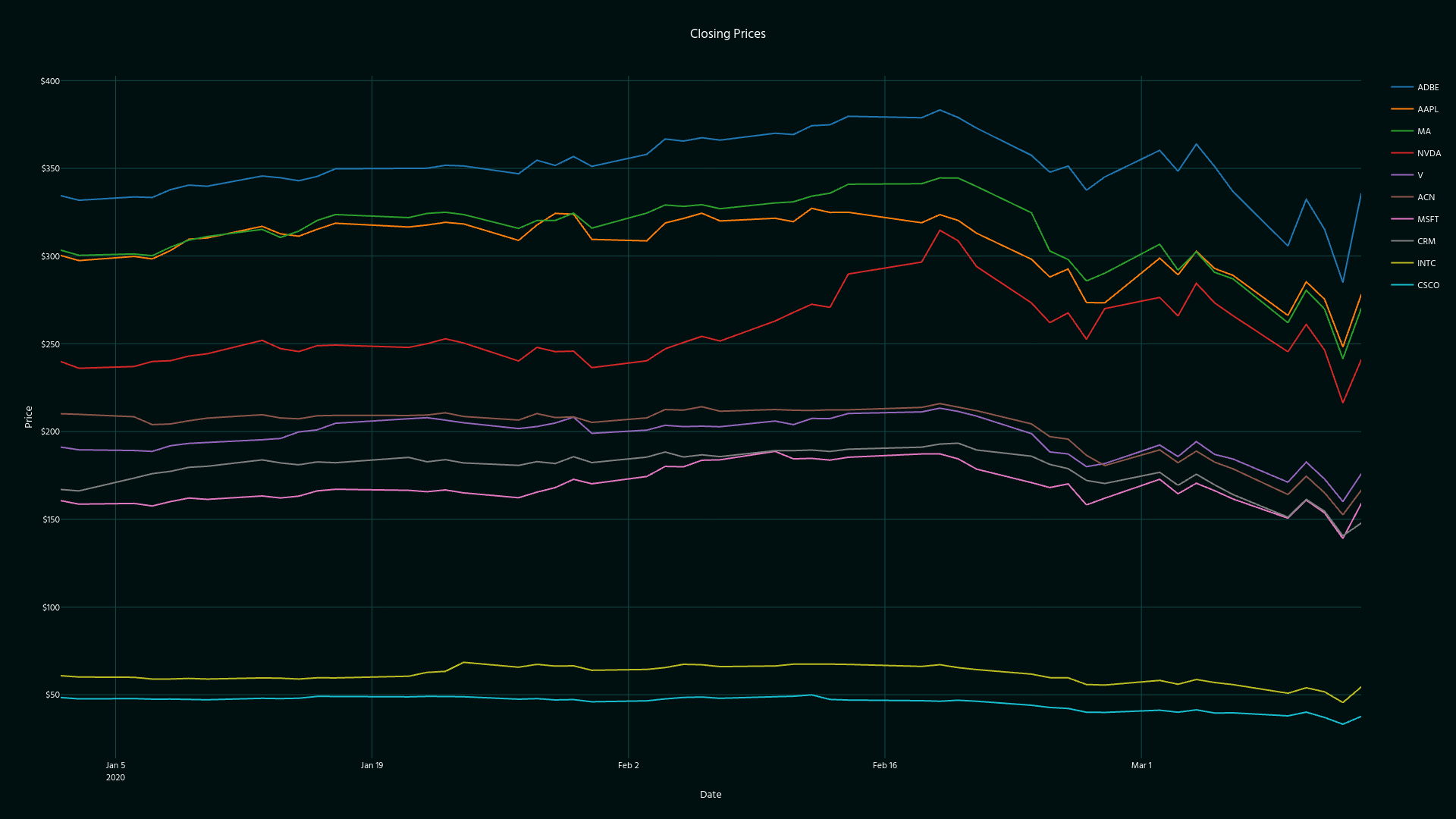

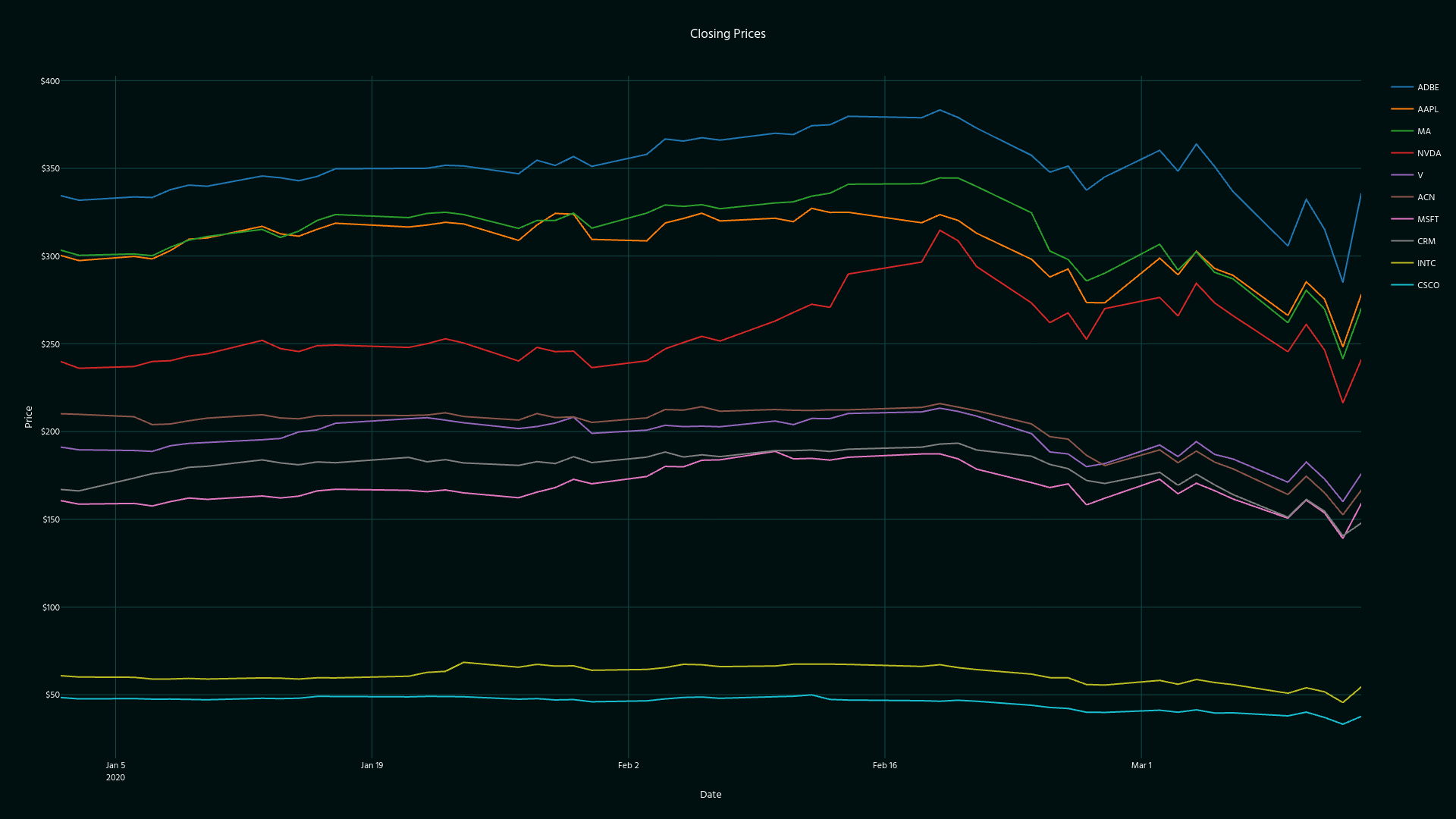

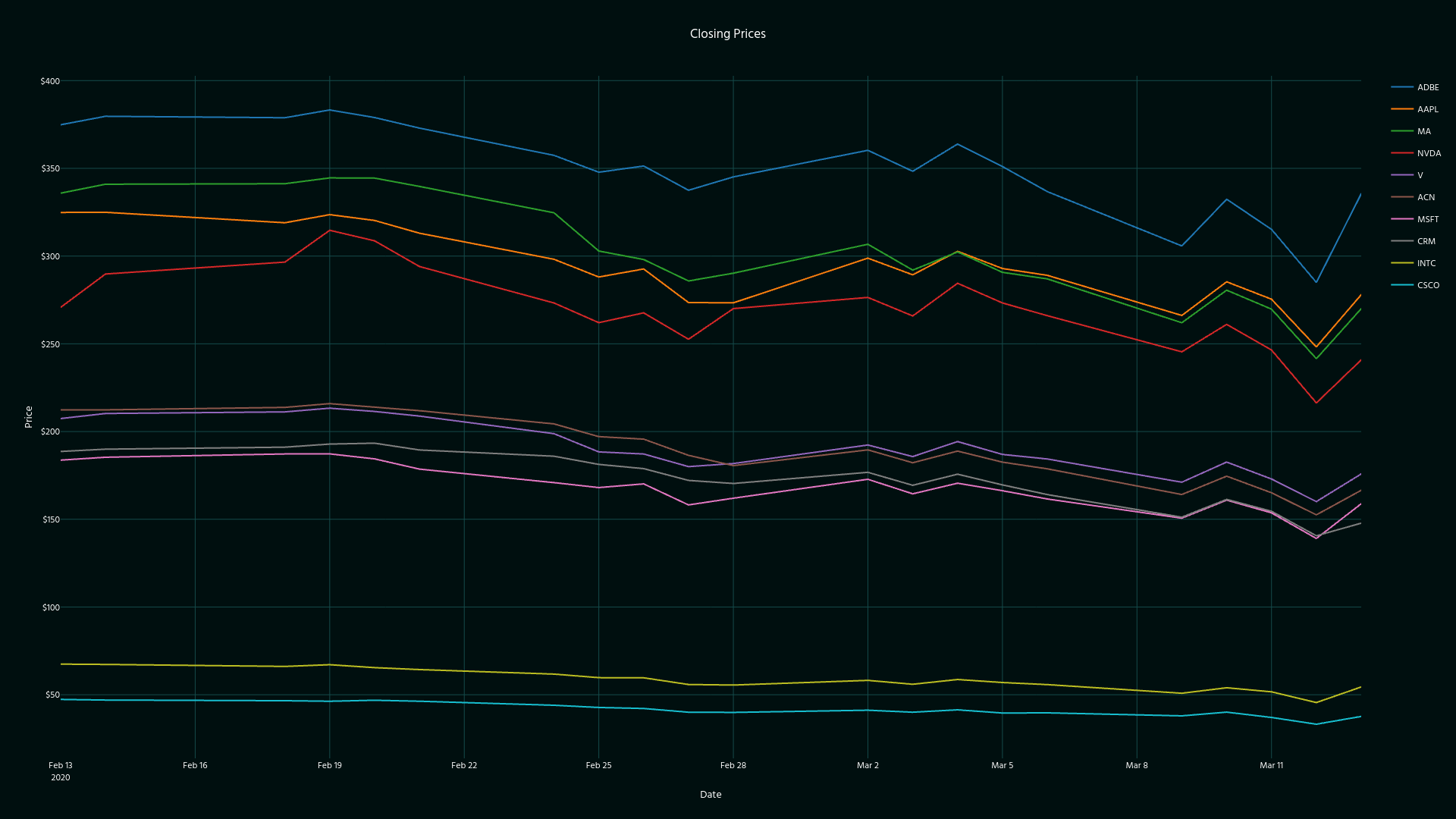

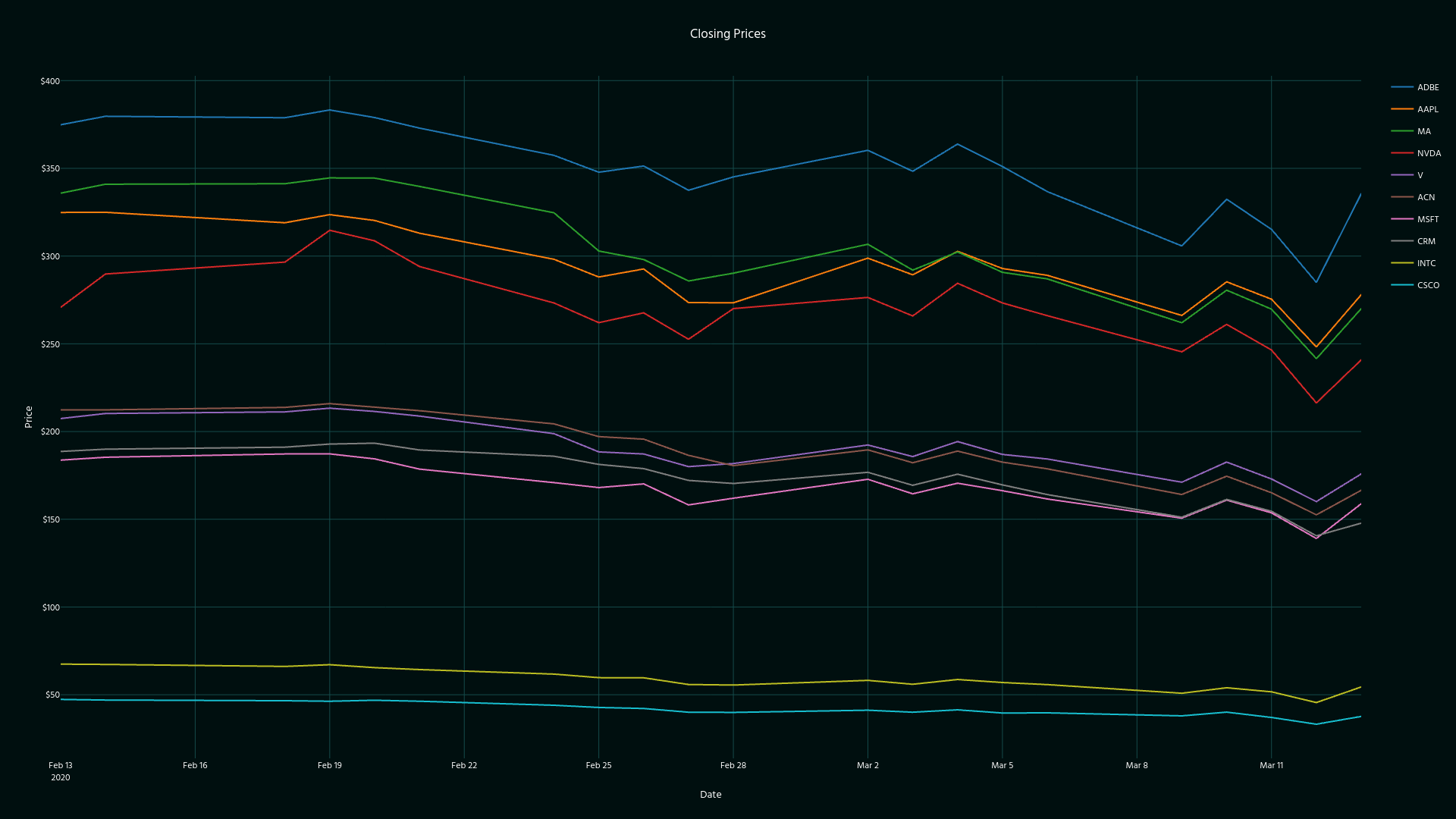

Line charts of decreasing look-back period are also presented in trio. Their increasing correlation is illustrated by the parallel lines of parallel price movements.

Fig. 4: Line chart for TECL from 2019-03-13 to 2020-03-13

Fig. 4: Line chart for TECL from 2019-03-13 to 2020-03-13

Fig. 5: Line chart for TECL securities from 2020-01-01 to 2020-03-13

Fig. 5: Line chart for TECL securities from 2020-01-01 to 2020-03-13

Fig. 6: Line chart for TECL securities from 2020-02-13 to 2020-03-13. Note that securities are moving almost perfectly in parallel.

Fig. 6: Line chart for TECL securities from 2020-02-13 to 2020-03-13. Note that securities are moving almost perfectly in parallel.

Conclusion

In market routs, leveraged funds with long positions whose correlations increase may exhibit precipitous decline. The inclusion of assets classes such as cash, bonds, certain commodities, or real estate outside of real estate investment trusts may help investors weather stock market crashes. Financial derivatives, provided they were standardized and exchange-traded, survived even the toughest turbulence of 2008 without default. The problem is that volatile market conditions can make the derivatives used to hedge stock positions cost prohibitive once the bonfire of the volatilities begins.