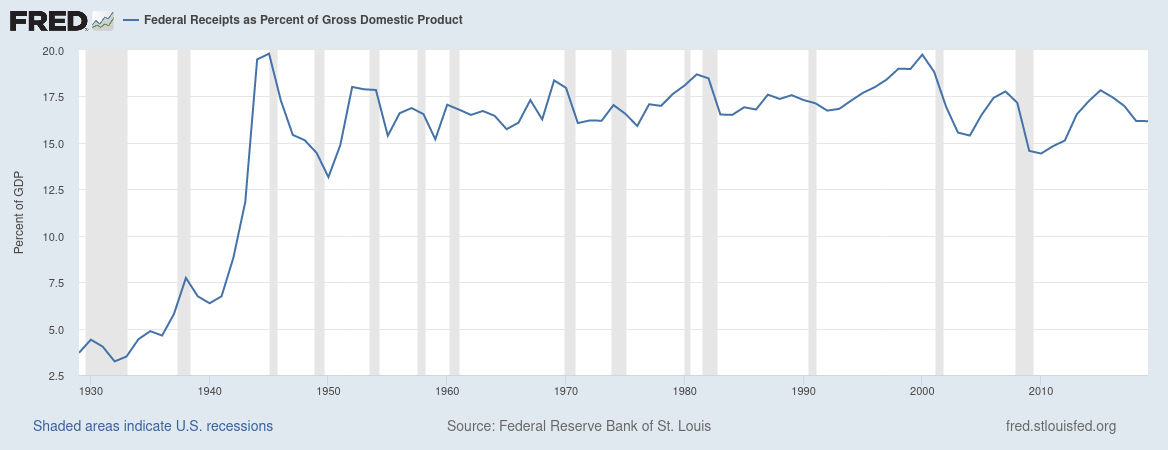

Coronavirus relief will not be financed through through traditional taxes, but through inflation of the monetary base. The debate over tax rates obscures the remarkable stability of federal tax receipts.

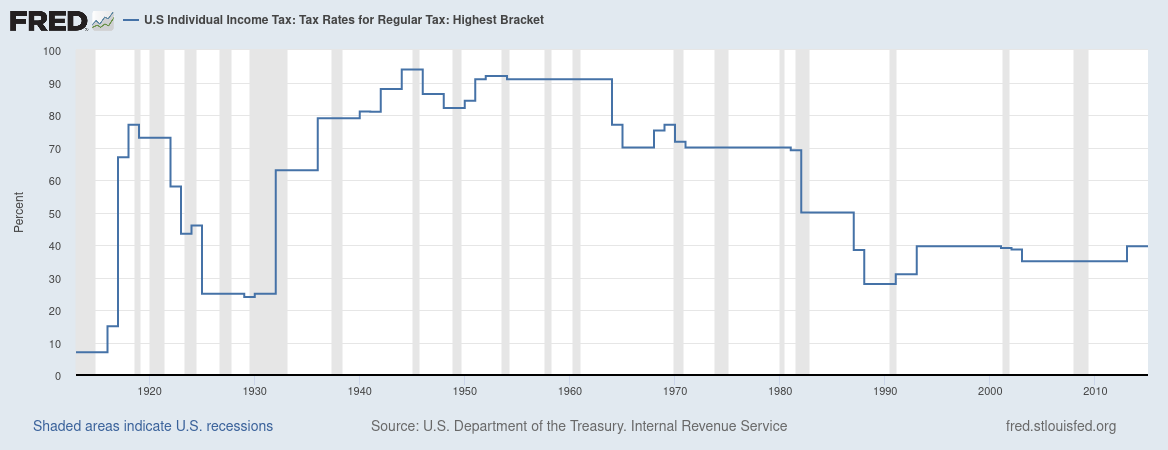

Since 1946, federal revenue averaged 16.82% of gross domestic product (GDP). A return to the marginal rates of yesteryear, which were at times above 90%, is therefore unlikely to yield additional revenue. A graph illustrating top marginal tax rates over time immediately follows:

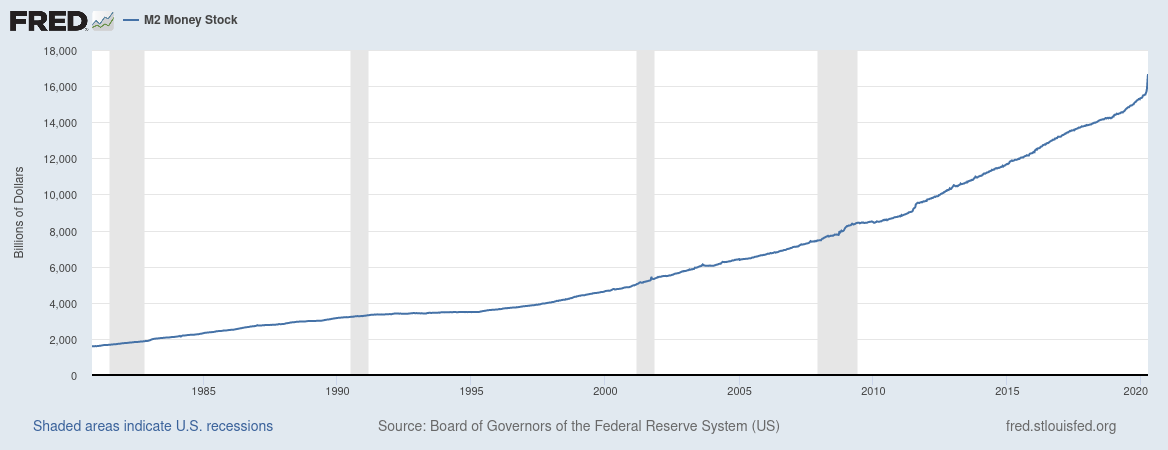

Ben Bernanke, a former Chair of the Federal Reserve, acknowledged that inflation is a tax. Since there is no branch of government that can override actions taken by the central bank, inflation is a tax that can be levied with neither the consent of the governed nor the consent of the government. Its uneven effects are captured by neither one of the previous graphs, meaning that both graphs systematically understate the true levels of revenue and taxation. Inflation of the M2 Money Stock is illustrated by the following graph:

Since the year 2000, the annualized increase in the M2 Money Stock has been approximately 6.5% of GDP. Discounting the present DOW by the growth of M2 implies a 2020 average of 38,000 just to maintain parity. Conversely, a DOW 24,000 today would discount to a 2000 DOW of only 6,800. The precise ratios are not ultimately what matters. The problem is that the United States has not been able to outpace its rate of monetary creation for decades.

Dysrationalia is the incapacity for rational thought despite sufficient intelligence. Its literal definition, bad ratios, is also its dystopian manifestation. Like inflation, it is a transmissible disease with exponential, viral dynamics whose sequelae will endure long after the acute infection subsides. Coronavirus relief is necessary because the current crisis is one in which many people are both unable to work and unable to look for work. But make no mistake: payment for this relief will not be made through the tax code.